US Ambulatory Surgical Center Market Segmentation by Specialty and Procedure Type

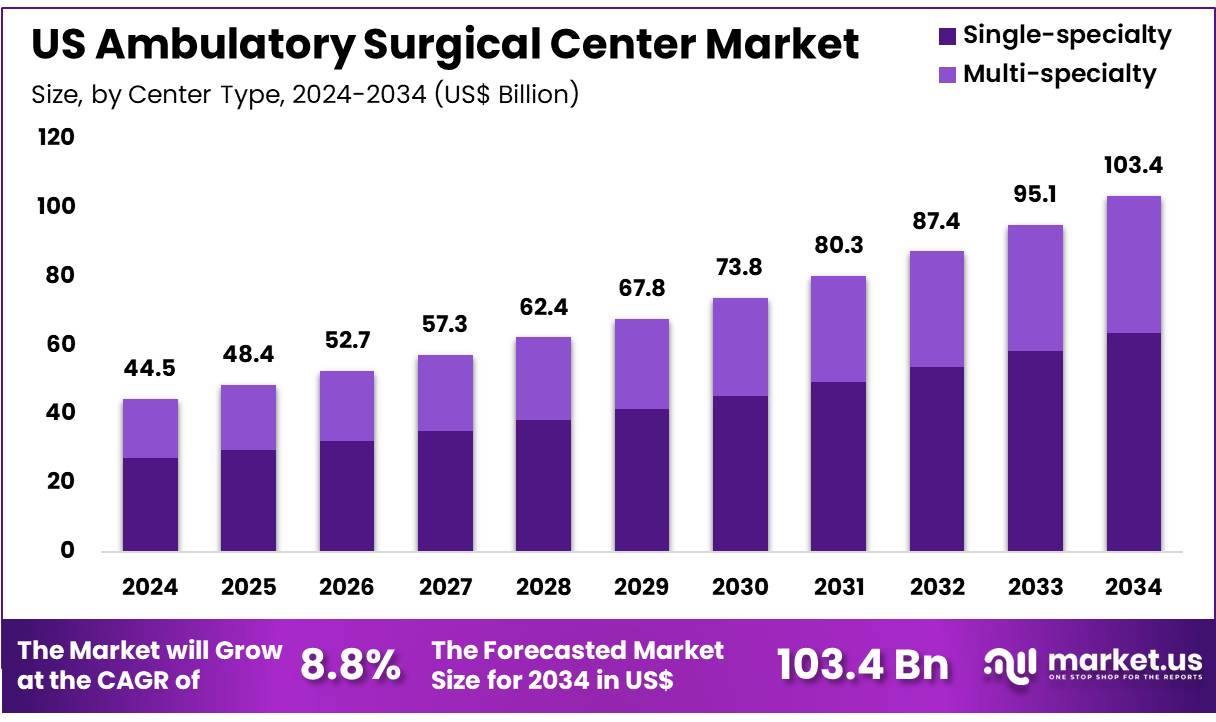

The US Ambulatory Surgical Center Market size is expected to be worth around US$ 103.4 Billion by 2034 from US$ 44.5 Billion in 2024, growing at a CAGR of 8.8% during the forecast period 2025 to 2034.

In 2025, the U.S. Ambulatory Surgical Center Market is embracing retail-inspired consumer experiences to appeal to today’s healthcare consumers. New ASCs are being designed with spa-like waiting areas, concierge navigation, and branded care experiences that rival upscale retail clinics—without compromising clinical rigor. Patients encounter same-day check-in kiosks, instant e-payments, and seamless coordination via proprietary apps.

Centers are adding on-site outpatient imaging, labs, and pharmacy services to provide one-stop surgical care. As transparency tools publish procedure cost and success metrics, ASCs are investing in brand and experience to attract informed consumers seeking quality, convenience, and value—all in one setting.

Click here for more information: https://market.us/report/us-ambulatory-surgical-center-market/

Key Market Segments

Center Type

- Single-specialty

- Multi-specialty

Ownership

- Physician Owned

- Hospital Owned

- Corporate Owned

Speciality

- Orthopedics

- Pain Management/Spinal Injections

- Gastroenterology

- Ophthalmology

- Others

Emerging Trends

- Retail-style ASC design with concierge services and branded ambiance.

- On-site labs, imaging, and pharmacy for integrated, one-stop surgery visits.

- Patient portals offering cost estimates, provider profiles, and procedure success data.

- Mobile apps for same-day check-in, real-time updates, and post-care tracking.

Use Cases

- A boutique ASC allows patients to check-in via kiosk, access pre-op café, and download same-day care guide.

- Imaging and labs are completed on-site before minor joint surgery—no extra appointments needed.

- A patient views cataract surgery options, prices, and surgeon ratings via an ASC-branded app.

- Post-op alerts and checklists are sent to patients via app, reducing follow-up calls by 30%.

Comments

Post a Comment